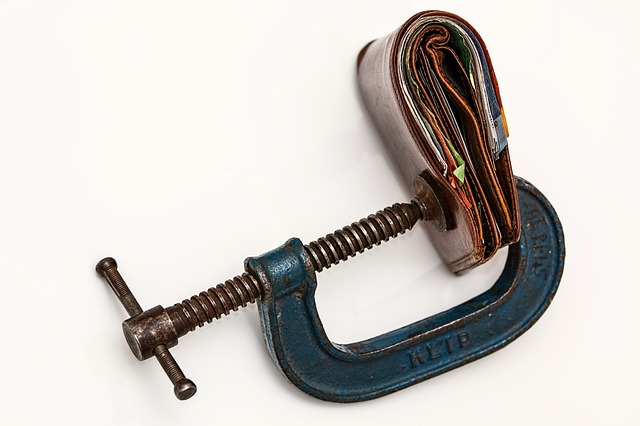

If you are overwhelmed by debt, it can be a very frightening experience. Sometimes it happens quite quickly, from some financial problems to losing all control in a matter of weeks or months. Once you realize you have to handle the problem, the real struggle begins. The following article will give you some pointers on what to do regarding bankruptcy if you are way over your head in debt.

Do not hesitate to remind your lawyer of any details regarding your case. Never assume that they can remember all details without reminders. Don’t fear speaking up since it affects your case and future.

Do not give up. If you’ve had collateral, such as a car, electronics, or jewelry repossessed for non-payment, you might be able to recover the property when you file for bankruptcy. If you have property repossessed less than ninety days prior to filing your bankruptcy, you may be able to get it back. A qualified bankruptcy attorney can walk you through the petition process.

Find a bankruptcy attorney who offers free consultations, and ask lots of questions. Almost all lawyers will give a free consultation, so meet with more than one before making a decision on whom to hire. Make your decision after all of your questions have been answered. After your consultation, take your time to make your decision. This allows you time to speak with numerous lawyers.

Many bankruptcy lawyers offer free consultations, so go to several before choosing one. Be certain to speak with an attorney, not their paralegal or law clerk, since they cannot give legal advice. Looking for an attorney will help you find a lawyer you feel good around.

It is important to protect your home when filing bankruptcy. Bankruptcy doesn’t always mean you’ll lose your home. If your home has significantly depreciated in value or you’ve taken a second mortgage, it may be possible to retain possession of your home. It can be worthwhile to understand the homestead exemption law to see if you qualify to keep living in your home under the financial threshold requirements.

Spending time with the people you love is something you should do now. Bankruptcy can really wear down your emotional reserves. It is lengthy, stressful and often leaves people feeling ashamed, unworthy and guilty. Lots of people choose to disappear for a while until the entire process is over and done with. This is not recommended because you will only feel bad and this may cause you to feel depressed. So, it is critical that you keep spending time with the ones you love, regardless of the current financial situation.

If you are making more money than you owe, bankruptcy should not even be an option. Sure, bankruptcy can get rid of that debt, but it comes at the price of poor credit for 7-10 years.

Refrain from feeling shameful about your bankruptcy. The bankruptcy process makes people feel guilty and ashamed. These sorts of feelings are not helpful to you. Indeed, they may cause you mental anguish. A good way to deal with bankruptcy is to make sure that you keep a stiff upper lip.

Filing for bankruptcy is hard on anyone, and can cause extreme amounts of stress. One way to help reduce is this stress is to hire a reliable attorney. Get recommendations and look into other qualifications rather than just choosing based on cost alone. Hire the best attorney you can afford, not the one who charges the most. Ask people who have used a bankruptcy lawyer for referrals, look them up at your local Better Business Bureau, then schedule free consultations in order to interview them. You might want to visit a court hearing and observe lawyers handling their cases.

Try your hardest to present a complete representation of your current financial situation. If you forget information you run the risk of having your petition delayed, or possibly even dismissed. No sum is too small to be included; err on the side of caution and include everything. Current loans, second jobs and assets ought to be included.

Pay attention to how you satisfy any personal debts before filing for bankruptcy. Some bankruptcy rules do not allow you to send money to creditors within three months of filing; this can extend up to a full year if a loved one is involved. Know the laws prior to deciding what you are going to do.

Be sure to list any and all debts that need to be eliminated when you file your bankruptcy paperwork. Debts that you leave out of your filing paperwork will not be addressed during the bankruptcy proceedings. It’s imperative that you record each and every debt, so that nothing gets missed in the petition.

Don’t stop the the bankruptcy process if you find a job. It might still be wisest to file for bankruptcy. The timing of your filing is also going to be important. Repayment can be evaluated without new income if the filing is posted earlier.

No matter what’s going on, make sure you tell the truth about your situation. Lying about your assets and debts can get you into serious trouble. It is very illegal. You could go to prison for lying on a bankruptcy petition.

It can easy to be overwhelmed by life and feel as if you have lost control. The above article has provided you with advice to allow you to handle your finances and deal with the option of bankruptcy. Use this information to make a fresh start!