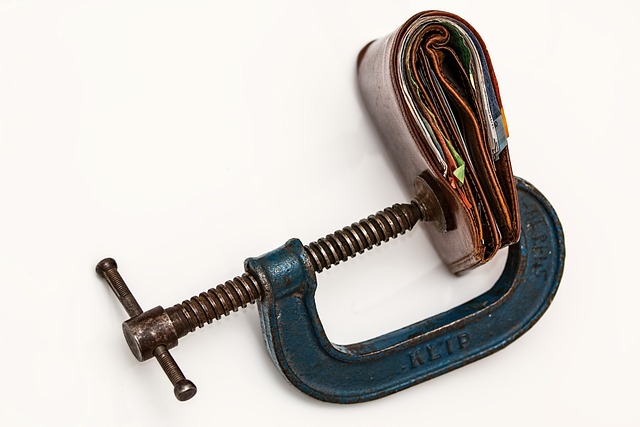

While filing for bankruptcy may be a hard decision to make, for some it is a necessity. The best way to deal with the process is to become educated on the subject. The information in this article contains information and advice from people who have actually gone through the process.

Be sure everything is clear to you about personal bankruptcy via looking at websites on the subject. The United States Check out the Bankruptcy Institute site and do some research about consumer’s rights. The more knowledgeable you are, the more you can be sure that you are making the right decision and that you are taking the right steps to ensure your personal bankruptcy goes as smoothly as possible.

Before you file for bankruptcy, carefully consider if it is the right option for you. Debt advisors are one of the many other avenues you can consider. Bankruptcy stays on your credit for a whole decade, so if there are less drastic options that will solve your credit problems, it is in your best interest to make use of them.

When you realize that you probably will file for bankruptcy, do not pay your creditors or try to avoid bankruptcy by spending all of your regular or retirement savings. Retirement funds should be avoided at all costs. Though you may have to break into your savings, keep some available for difficult times. You will be glad you did.

Determine which of assets are safe from seizure and which are not before filing for personal bankruptcy. The Bankruptcy Code contains a list of various assets that are excluded from bankruptcy. It is vital that you completely understand which assets are protected and which assets can be seized prior to filing bankruptcy. If you do not read this list, you could be in for some nasty surprises in the future, if some of your most prized possessions are seized.

You must be absolutely honest when filing for personal bankruptcy. If you try to hide any of your information, it will eventually surface and cause you problems. Whomever you plan to use should know a lot about the finances that you have, both the good and the bad. Bankruptcy can be a chance to simplify your finances, but any schemes you employ to conceal the truth can ruin that chance for you.

It is important to understand your rights when filing bankruptcy. Once bankruptcy has been filed, you may be able to regain possession of items such as electronic goods or cars that were taken away from you. If you have been subject to a repossession during the 90 days before your filing, you stand a good change of getting your property back. A lawyer will be able to assist you with filing the paperwork to get the items back.

Many bankruptcy lawyers offer free consultations, so go to several before choosing one. Never settle for speaking with a paralegal or an assistant. They are not trained, nor allowed, to pass on legal advice. Be sure to check out a number of lawyers so that you will find one who is just right for you.

If you are concerned about keeping your car, check with your attorney about lowering the monthly payment. In many cases, Chapter 7 bankruptcy can lower your payments. There are a few requirements that you have to meet to be eligible, though. You have to have bought the car more than 2.5 years ago, your loan’s interest rate needs to be over a certain amount, and your employment history has to be good.

Chapter 7

Remember that filing for Chapter 7 personal bankruptcy will not just affect you. Think about the effect it will have on business associates, friends and family or anyone else who may be a co-signer with you. Once you file for Chapter 7 bankruptcy protection, you no longer have legal responsibility for debts that you and any co-signers originally agreed to. However, creditors can demand co-debtors pay the amount in full.

Be certain to have a good understanding of bankruptcy regulations prior to filing a petition. Here is one example, an individual who files for bankruptcy cannot transfer any assets for a year before the filing date. In addition, it is unlawful for the filer to increase the amount of debt they are carrying on their credit cards right before they file.

Do not take too long deciding that it is time to declare bankruptcy. While it may be difficult to accept that you are in trouble, waiting only prolongs the agony. By talking to a professional, as soon as possible, they can give you some advice on things you can do before it all gets too complicated.

Sometimes declaring personal bankruptcy is simply unavoidable. Now, equipped with the information from this article, you can handle the process much more completely. Spending some time learning for others who have gone through the same thing reduce some of your stress.