Having negative credit can bring negative reactions from companies that you might encounter in the future. Negative credit can affect your future. There is a way, however, to repair your credit and it will open more doors in your life. Follow the tips and information below to get started cleaning up your credit.

If you are buying a home it will not always be easy, and even more difficult if your credit is bad. If this is the case, try to get an FHA loan, which are loans backed by federal government. FHA loans are ideal for those who cannot afford the high down payment that most banks require.

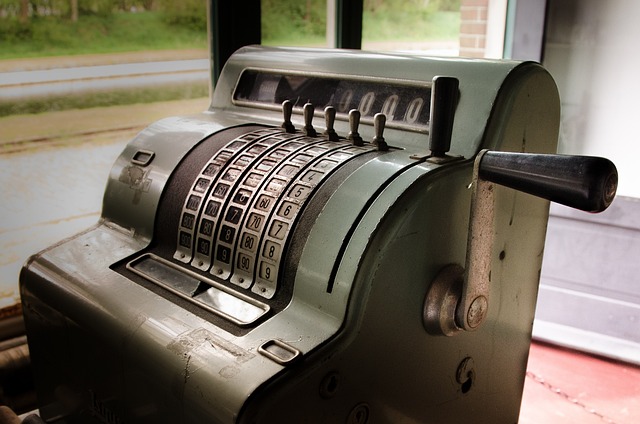

Credit Card

If you need a credit card to aid in fixing your credit but you cannot obtain one due to the state of your credit, applying for a secured credit card is an option. You will most likely be approved for this type of card, but you will have to add money to the card before you can use it so the bank will know that you can pay for all of your purchases. If you use a credit card responsibly, you will go a long way in repairing your credit.

Paying your bills is a straightforward, but truly vital prerequisite for credit score repair. More importantly, you need to start paying your bills in full and on time. Once you have started to pay towards your past-due accounts, you credit score will gradually improve.

Ffiliate=rtfaith&vendor=credi28″ Target=

Credit counselors should always be researched thoroughly before being consulted for credit improvement. Many may have ulterior motives, so make sure you are not being duped. Other options are clearly scams. Wise consumers always verify that credit counselors are legitimate before dealing with them.

If you’re trying to fix your credit, be sure to check all your negative reports carefully. The debt itself may be legitimate, but if you find errors in its metadata (e.g. the date, amount, creditor name), you might be able to get the whole entry deleted.

Start living within your means. You need to change your thinking to consider your future goals, not just buy all of the things you want right now. In recent years, easy credit has made it very fashionable for people to purchase the things that they cannot afford, and everyone is now beginning to pay the hefty price tag. Instead of spending more than you can afford, take a long hard look at your income and expenses, and decide what you can really afford to spend.

Any time you establish any payment plan with any creditor, make sure you get it in writing. Having the plan in writing will protect you if the creditor reneges on the plan or if your debt is transferred to another creditor. When you pay it off, send a written copy of proof of payment to all three credit reporting agencies.

These are ways of protecting your credit rating. Every late payment appears on a credit report, and could potentially hurt your chances at a loan.

Go through all the statements you receive. Take a second look to make sure that you are being charged only for what you actually purchased. You are the only one that can verify if everything on there is the way it should be.

Work with a credible credit improvement service. Too many of these services will use your desperation to make money. Some people have gotten scammed by these credit agencies. Take the time to read reviews of different agencies. This will allow you to find an honest one to work with.

Our initial inclination is to defend ourselves, but in truth, lenders will not even glance at your defending statement. It is possible that this can be detrimental by drawing closer scrutiny to your report.

Put your credit cards on lock down and don’t use them at all, if possible. Pay for everything with cold, hard cash. If you have no choice but to use a credit card, always pay the balance in full each month.

Debt Collectors

Having to deal with debt collectors is often very stressful and distressing. Cease and desist instructions can be used to ward off debt collectors to a point, but only really to prevent harassment. You will still have to pay what you owe even if collection agencies stop calling you.

Be wary of any company that tells you they can instantly fix your credit. Less ethical lawyers have realized that with the current glut of consumers with credit trouble, there is money to be made by charging high fees for ineffective credit restoration help. Do your research before calling any lawyer for their help.

In order to rebuild your credit, take baby steps to start improving your score. Prepaid credit cards are one way in which you can repair your credit. These cards are used like a normal credit card and are reported to the credit bureaus; however, you can only use the amount of money you deposit into your account. This approach will indicate to others that you are serious about taking responsibility for your financial future.

Give yourself more opportunities by fixing your bad credit and making it good. Look into information on how to repair your credit. You will find ways you can do this yourself, without paying a credit score improvement company. You will be on the right road to find credit score improvement success if you heed these tips.