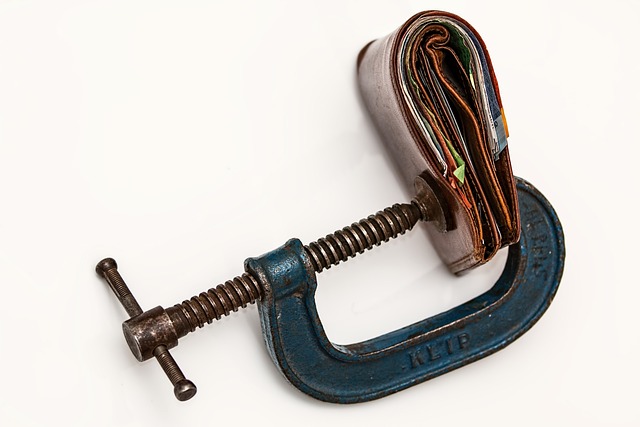

When you are drowning in debt, you may find yourself scared. Sometimes it happens quite quickly, from some financial problems to losing all control in a matter of weeks or months. Unfortunately, this problem is difficult to fix, once you realize you have it. This article will help you get through your bankruptcy with a minimum of hassle.

Many people need to file for bankruptcy when they owe more money than they can pay off. When you are faced with this issue, begin to familiarize yourself with your state’s laws. Different states use different laws when it comes to bankruptcy. For instance, some states protect you from losing your home in a bankruptcy, but others do not. Do not file before learning about the bankruptcy laws in your state.

When it appears likely that you will file a petition, do not start spending your last remaining funds on debt repayment. No matter what you do, do not touch your personal savings unless there is no other option. Though you may have to break into your savings, keep some available for difficult times. You will be glad you did.

Bankruptcy Petition

Ensure that you are providing genuine details when filing a bankruptcy petition, because honesty is the best policy when dealing with bankruptcy. Do not try to shield some assets or income from your creditors. This can get you in serious trouble and prevent your bankruptcy petition altogether.

Be sure to bring anything up repeatedly if you are unsure if your lawyer is focusing on it. Just because you have told him something of importance that he will remember it. Don’t fear speaking up since it affects your case and future.

After you have declared bankruptcy, you may have a hard time being approved for unsecured credit. If this happens to you, think about applying for a couple of secured credit cards. This will be a demonstration of the seriousness with which you view rebuilding your credit rating. If you pay your secured card off on time, you’ll eventually find that companies will start offering you unsecured credit.

If possible obtain a personal recommendation for a bankruptcy lawyer instead of randomly choosing one. There are plenty of companies who know how to take advantage of people who seem desperate, and it’s important to be sure your bankruptcy can go smoothly; take your time and choose someone you can trust.

Determine which assets won’t be seized before filing for bankruptcy. The Bankruptcy Code lists assets considered exempt from being affected by bankruptcy. You can determine exactly which of your possessions are at risk by consulting this list before you file. If you aren’t aware of this, you could lose some assets that you value.

Make sure you are completely honest when filing for bankruptcy. Hiding your assets is never wise. Whomever you plan to use should know a lot about the finances that you have, both the good and the bad. Never hide anything, and make sure you come up with a well devised plan for dealing with bankruptcy.

Chapter 7

Before filing for bankruptcy, determine whether Chapter 13 or Chapter 7 is appropriate for your financial situation. In Chapter 7 bankruptcy, your debts are all eliminated. Any ties that you have with creditors will be dissolved. In a Chapter 13, though, you’ll be put on a payment plan for up to 60 months before being free of your debts. You need to be aware of the pros and cons of each type of bankruptcy so you can correctly select the best choice for your situation.

If you’re unsure, then you need to learn what a Chapter 7 bankruptcy can do for you, as opposed to what Chapter 13 does. Take the time to find out about each one online, and look at the advantages and disadvantages of each. Go to a specialized lawyer to ask your questions and get some useful advice on what to do.

Consider filing using chapter 13 bankruptcy. If you posses a regular source when it comes to income, and you have less than $250,000 of unsecured debt, you could file using Chapter 13 bankruptcy. This type of bankruptcy protects your assets from seizure and lets you repay your credits over the course of a few years. Expect to make payments for up to 5 years before your unsecured debts are discharged. Stay mindful that should you for any reason miss even one plan payment, your whole case is going to get thrown out by the court system.

When your financial situation starts to get really ugly, it can be easy to feel like you need help. By following the pointers presented in this article, you will be able to keep your finances under control while proceeding through bankruptcy. Use the advice that you have been given to make some changes in your life.