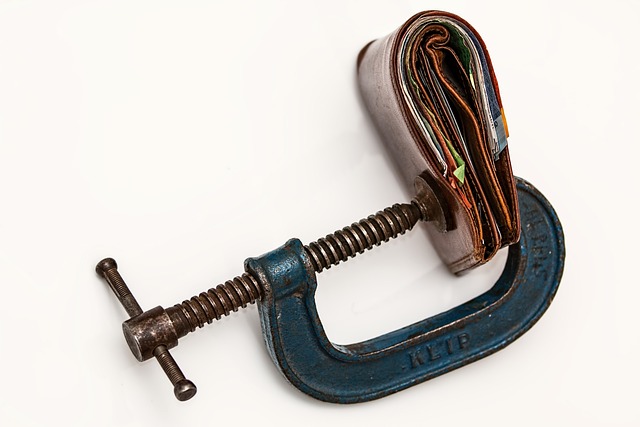

Are your finances so awful that you are considering filing for bankruptcy? Fear not, you are in good company. A lot of people have thought of bankruptcy as the only choice they had to get rid of their financial troubles. This article contains advice on bankruptcy that can help you go through the process as smoothly as possible.

Filing for bankruptcy is something many people are forced to do when there debts become too much of a burden, and they can no longer afford to pay them. If you’re in this position, it is a good thing to familiarize yourself with the laws that apply in your area. Laws differ from one state to the other. For instance, in some states you can keep your home and car, while other states prohibit this. It is best to become familiar with your state’s laws regarding bankruptcy before you take the steps to file.

Ask yourself if filing for bankruptcy is the right thing to do. Alternatives do exist, including consumer credit counseling. Bankruptcy has a negative effect on your credit reports, in that it is permanently there. Before you take this step, make sure all your options have been considered.

Prior to putting in the bankruptcy paperwork, determine what assets are protected from seizure. The Bankruptcy Code provides a listing of the various asset types that are not included in the bankruptcy process. You need to read the exemptions for your state, so you know what property you can protect. If you fail to do so, things could get ugly.

You should never pay for your first consultation with a bankruptcy attorney. Make the most of this free consultation by asking lots of questions. Most lawyers offer free consultations, so consult with a few before settling on one. Make a choice only if you have received good answers to all the questions and concerns you brought to the table. There is no need to feel rushed to decide to file after you talk with your bankruptcy lawyer. Consulting with several attorneys will also help you find someone you trust.

Be sure to weigh all of your options before deciding to file for personal bankruptcy. For example, consumer credit counseling programs can help if your debt isn’t too large. You may have the ability to negotiate much lower payments, just be sure any debt modifications you agree to are written and that you have a copy.

Protect your home. Bankruptcy doesn’t always mean you’ll lose your home. It may be possible to keep your home if the value has depreciated, or there is a second mortgage. Additionally, some states have homestead exemptions that might let you keep your home, provided you meet certain requirements.

Determine if bankruptcy is necessary. You may well be able to regain control over your debts by consolidating them. It can be quite stressful to undergo the lengthy process of filing for personal bankruptcy. Your future credit will be affected by these actions. Therefore, before you file for bankruptcy you need to consider all of your alternatives.

Chapter 13 Bankruptcy

Research Chapter 13 bankruptcy, and see if it might be right for you. Chapter 13 bankruptcy is a good choice for people whose unsecured debts amount to lower than $250,000 and who receive a regular income. Not only can you repay your debts through consolidation, personal property can be kept, as well as real estate. This lasts for three to five years and after this, your unsecured debt will be discharged. Remember, though, that if you fail to make even one payment, the case will be thrown out and you’ll be right back where you started.

Do not forget to make quality time for friends and family members. Bankruptcy proceedings can be extremely harsh. Having to declare bankruptcy leaves many people feeling like a failure. Some people do not even want to speak with others until the bankruptcy is official. This isn’t true though because when you isolate yourself you will just start to feel worse and may become depressed. This is the reason that you need to take the time out to spend time with everyone you love despite what your financial situation is.

As mentioned before, you are not alone in your bankruptcy journey. Unlike the uninformed masses, however, you took the time to read this article, so you are more informed. Put the tips you learned into action so that you can ensure your bankruptcy process moves along without trouble.